Stockpicking for success

in turbulent times

Sponsored by

2022 was meant to be the year we learnt to live with Covid, economies returned to full health and stock markets responded accordingly. But fears of recession soon replaced hopes of recovery. In the middle of such economic turbulence and market volatility, how can investors ensure their portfolios continue to perform?

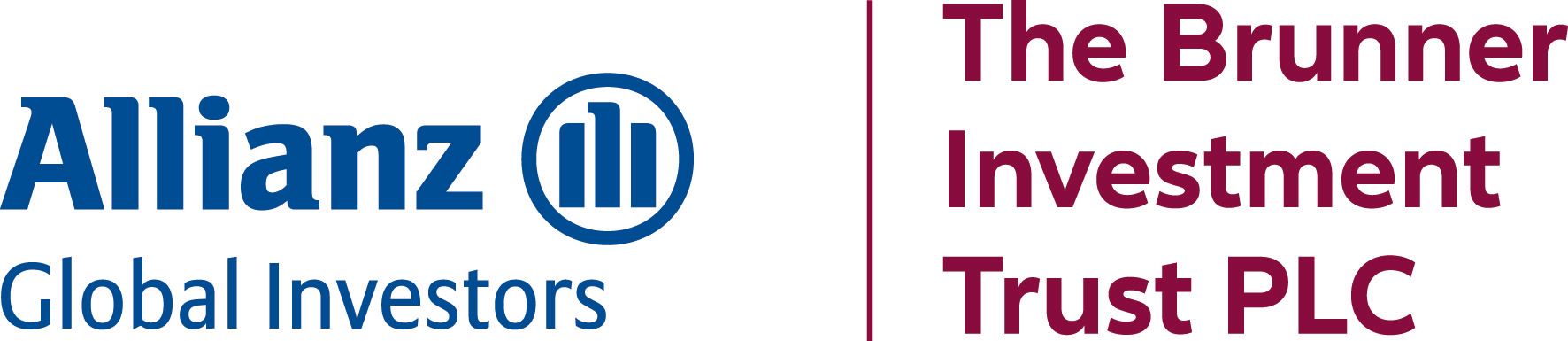

Sound as the received wisdom might seem, simply ignoring the market ‘noise’ has become significantly more difficult in the past 12 months. Rampant inflation, rising interest rates and the prospect of a deep recession have helped to drive almost every major equity market down in the past year, with many investment portfolio mainstays looking troubled.

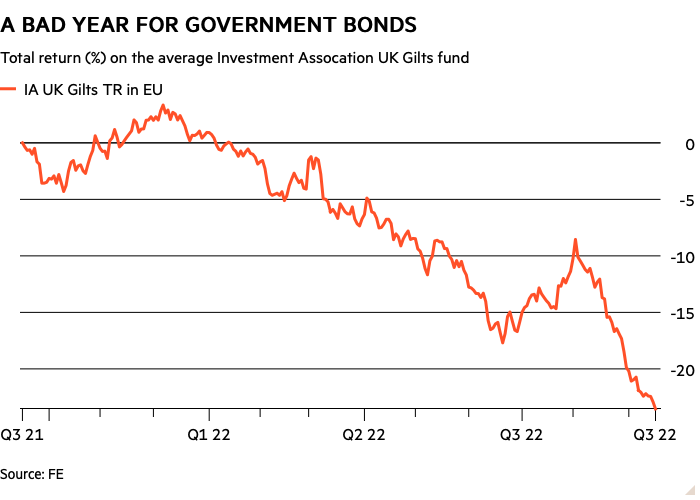

Tech stocks and other popular growth shares have derated substantially, while defensive assets such as government bonds have seen their valuations crash as we appear to finally exit a period of historically low interest rates. From bargain hunters to those simply looking to shield their assets from further volatility, investors are facing up to a much different environment versus that of the last decade.

Investing well in a time of deep uncertainty is no simple thing, but the multi-disciplined panel attending our Stockpicking for success in turbulent times event struck something of a pragmatic note. While no panellist tried to downplay the difficulties ahead, they did reiterate some useful mantras for getting through such challenging times – and perhaps even making some savvy investments, provided you have the right attitude and timeframe.

investors are facing up to a very different environment versus that of the last decade

quality investing

The panelists firstly pointed to some broad areas that look well-positioned for a world of high inflation and a potential economic downturn. Christian Schneider, portfolio manager on the Brunner Investment Trust, which styles itself as an all-weather global equity fund, suggested the quality investing style could ultimately prosper again – in part because companies with a strong economic moat should be able to raise their prices as inflation bites. He added that gross margins could serve as a useful metric to identify those companies that are in fact successfully raising their prices, while adding that companies in a good financial position could get stronger in trying times. “There might be a beneficiary of the current environment, with companies able to expand their market share,” he said.

Others did broadly agree with some of these points. Ben Seager-Scott, head of multi-asset funds at Evelyn Partners, note that there “will probably be a place for some of those higher-quality companies and defensive companies”, pointing in particular to consumer staples companies as ones that could pass on a lot of their costs, while healthcare and utilities could also prove sturdy after a period out of favour. He echoed Schneider in warning that companies with greater leverage and cyclicality could be vulnerable in the event of an economic slowdown – a useful point for those piling into cyclical stocks in the past year.

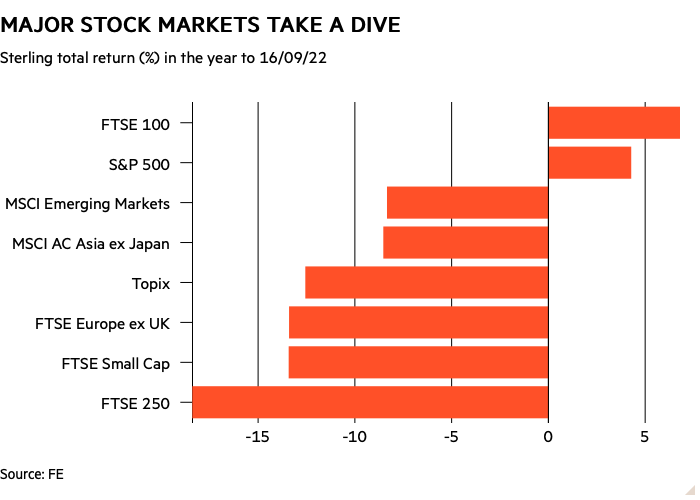

Some indicators of investor sentiment do point to such concerns feeding through: Association of Investment Companies communications director Annabel Brodie-Smith noted that the average commodities investment trust now traded on a share price discount to its underlying net asset value (NAV). “With a recession coming, people are beginning to price that in,” she said.

Annabel Brodie-Smith noted that the average commodities investment trust now traded on a share price discount to its underlying net asset value

resilient sectors

Valuations have at least moved to some interesting extremes, and any investor looking to reposition their portfolio should pay them some attention. Sticking with the investment trust space as one example, accessing resilient sectors with a level of inflation-proofing such as infrastructure has continued to involve paying a share price premium to NAV, although this may seem justified to those seeking out safe havens or reliable income. Whether it’s investment trusts or equities more generally, sectors such as technology continue to offer valuations that are at least optically cheap, for the brave investor who has done the research.

Looking beyond stocks, one area that many have started to be viewed as cheap is fixed income. Seager-Scott noted that the asset class was “interesting for the first time in a long period”. Taking government bonds as one example, yields which move inversely to prices have shot up this year – offering an appealing level of income and some room for yields to fall, and prices to rise, if equity markets sell off again.

Our lively session saw one viewer challenge this point, arguing that government bond yields remained “deeply negative” in real terms – but Seager-Scott made the case that real yields looked positive if plotted against inflation forecasts over a decade. As with any other “cheap” assets, investors may have to hold out for some time before an investment comes good.

As with any other “cheap” assets, investors may have to hold out for some time before an investment comes good

recession?

In a debate largely led by macroeconomic concerns, the prospect of rapid monetary tightening plunging the world into recession seemed difficult to ignore. But this was one area where experts struck a relatively upbeat note. Chris Bailey, chief economist at Celtic Financial Planning, noted that recessions were a part of life, adding: “I’d be more concerned if we weren’t seeing rises in interest rates”. Others agreed that central banks looking to tackle inflation should be seen as a positive.

Moments of turbulence are often seen as a way both to exploit mispricings and to pick out winning stocks, and the panel pointed to the fact that economic challenges and higher interest rates could spur a more productive use of capital. Schneider noted that “zombie” companies that have only managed to survive thanks to rock bottom rates could finally meet their end, with Seager-Scott adding that a “gentle cleansing” should see money going to a better place.

Moments of turbulence are often seen as a way both to exploit mispricings and to pick out winning stocks

Dos and don'ts

Ultimately an investor’s approach in such times will depend on their attitude to risk, their investment goals and what timeframe they have. But the panel pointed to various forms of good practice when turbulence strikes, from avoiding cashing out of your investments in the face of recession fears and missing out on market gains to diversifying properly and not being overly led by turns in sentiment.

Whether it’s the Buffetisms about fear and greed or mantras about selling on boom and buying on gloom, adventurous types may see now as the moment to put some cash to work, at least with a long-term mindset.

Sponsored by